Why Online Businesses Should Offer Bank-Account-Based Payments

In the rapidly evolving world of e-commerce, businesses are constantly seeking ways to enhance customer satisfaction. One key aspect that can significantly impact the success of an online business is the availability of convenient and secure payment solutions. Let’s delve into the reasons why online businesses should consider offering bank account-based payment options and the multiple benefits they offer to both businesses and their customers.

What are bank-account-based payment solutions?

Bank-account-based payment solutions are payment methods that allow individuals or businesses to make electronic transactions directly from their bank accounts. These solutions leverage the existing infrastructure of banks to facilitate secure and convenient transfers of funds.

A popular example of a bank-account-based payment solution is INTERAC®. INTERAC is a Canadian payment transfer method that allows individuals and businesses to transfer funds electronically between accounts at different financial institutions in Canada. It provides a range of payment services, including Interac e-Transfer.

Why does your online business need bank-account-based payment solutions?

Enhanced Convenience:

By integrating bank account-based payment methods such as Paramount Commerce’s INTERAC solution into your online platforms, businesses can provide customers with a seamless and user-friendly experience. Unlike traditional payment methods that often require manual data entry or authentication processes, bank account-based payments allow customers to transact quickly and effortlessly. With just a few clicks, customers can authorize transactions directly from their bank accounts, eliminating the need for credit cards or additional payment gateways.

Cost-Effectiveness:

Online businesses can significantly reduce transaction costs by implementing bank account-based payment solutions. Compared to credit card payments that often involve interchange fees, transaction fees, and other associated charges, bank account-based payments typically have lower processing costs. These savings can positively impact a business's bottom line and contribute to overall profitability.

Increased Security:

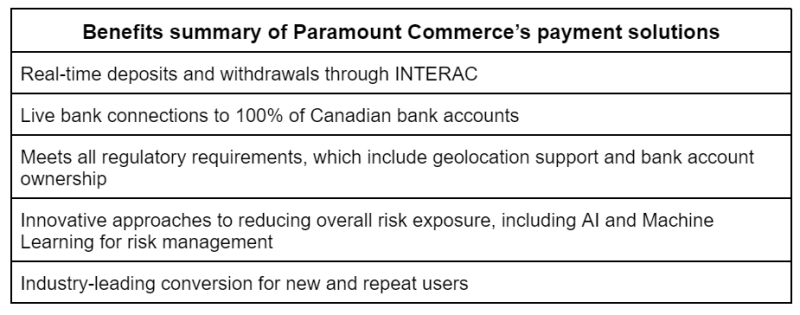

Security concerns are a top priority for both businesses and customers engaged in online transactions. Paramount Commerce is a trailblazer in the payments industry, utilizing cutting-edge technology to provide its clients with the most advanced risk management solutions. In fact, we are one of the only payment processors to incorporate AI and machine learning into their risk management strategies. This technology allows us to analyze data in real-time and quickly identify potentially fraudulent transactions, while also minimizing false positives. By leveraging the power of AI and machine learning, Paramount Commerce is able to provide its clients with the highest level of security and protection against payment fraud. This enhanced security instills trust and confidence among customers, encouraging them to make purchases more frequently through bank-account-based payment solutions.

Expanded Customer Base:

Integrating bank account-based payment solutions into an online business opens doors to a broader customer base. Some individuals either don't own credit cards or prefer not to use them for online transactions due to concerns about fraud or overspending. By providing alternative payment methods tied directly to bank accounts, businesses can cater to this segment of the population, ensuring that no potential customers are excluded based on their payment preferences.

Simplified Recurring Payments:

Many online businesses offer subscription-based services or products, requiring recurring payments from customers. Recently, Paramount Commerce launched its innovative One-Click payments feature through its Instant Bank Transfer product, making it one of the first payment processors in Canada to offer merchants the ability to accept one-click payments directly from a consumer’s bank account. This is a win-win feature for both merchants and consumers. For consumers, our One-Click feature streamlines the traditional payment experience, eliminating the need for consumers to provide their bank account details each time they make a payment or deposit, which helps in creating a seamless payment experience. With more consumers enjoying their simplified payment experience through our One-Click feature, operators benefit from an increase in consumer loyalty and improved customer conversion.

In today's fast-paced digital landscape, online businesses must stay ahead of the curve by offering payment solutions that prioritize convenience, security, and customer satisfaction. Implementing bank account-based payment options such as Paramount Commerce’s INTERAC or Instant Bank Transfer solutions, businesses can benefit from enhanced convenience, cost-effectiveness, increased security, access to a wider customer base, improved cash flow, and simplified recurring payments. By embracing these solutions, online businesses can foster trust, boost profitability, and achieve sustainable growth in the competitive e-commerce ecosystem.</p><p>Let our team help you simplify your payment needs: https://www.paramountcommerce.com/contact

Fintech trends and insights,

explained in 5 minutes or less

Fintech trends and insights,

explained in 5 minutes or less